The countdown is on for The British Shooting Show – book tickets online today and save on gate price!

Gundog insurance – issues to consider

I have kept gundogs for more than 30 years and in that time my vet’s bills have been mercifully small. Other than routine visits for inoculations and the occasional small cut, I haven’t had to dig deep into my bank balance to pay any bills. Then four years ago along came Percy.

Right from the word go I knew that he was going to cost me. By the time he was just six months I had already spent more than £2,000 in vet’s bills. He had a passion for eating socks and it always seemed to be out of hours. The final straw was when one got stuck in his intestines and he had to have surgery. I was also beginning to see that he was going to be a hard-hunting dog and I was convinced that at some point he was going to injure himself, so it was time to get both him and Ted insured.

If any of you have looked at getting your gundogs insured, you will already know what a minefield it can be. The most important thing is to ensure that you read the small print as some insurance companies exclude ‘working dogs’. You may consider this not to be an issue as the majority of the time your gundog may be considered a ‘pet’ dog, especially during the close season. Consider the following, however.

A hard-hunting dog could easily pick up an injury in the field

Social media

If your dog injures itself when out beating or picking up and you put in a claim it is easy nowadays for an insurance company to check through social media to see if you work your dog. Many of us post pictures of our dogs retrieving pheasants or sitting patiently at a peg, so a few quick clicks and there is a fair chance your insurance claim will be rejected. So a policy that specifically covers working dogs is needed. This will cost you a bit more but, like me, I am sure that you will conclude it is worth it.

Before I decided this I asked myself whether the cost of the premium was the best value compared with the option of putting an amount of money away each month to cover the cost of any injuries or illnesses. That’s all well and good if you are disciplined enough and you can put enough away to cover what may happen in the future. To put this into some kind of perspective, if you have read my regular diary article on Ted you will have seen we have had quite a month with him. I am not going to go into details in this piece but I think it would be useful if I share with you some of the costs.

Ted stayed in a vet’s hospital for seven days and nights. Each overnight stay was £400 and that excluded treatment. He had blood tests, an X-ray and an ultrasound scan, which came to just under £700. Specialist wide spectrum blood tests came to another £450, and we still have ongoing veterinary check-ups. As it stands, the bills are well into four figures. Our monthly insurance premium is just under £60, and that is for both Ted and Percy with a maximum payout limit of £6,000 each per year. I thought that would be more than enough but you don’t have to be a mathematician to work out that you can very quickly run up a large bill. If I had managed to put away £100 a month it would have taken me five years to save up enough to pay for this one claim – and remember, that is saving just for one dog.

Cost of treatment

I know that in this day and age money is tight for a lot of people and I for one am so grateful we had insurance, as I am not sure how or even if we could have raised the money for Ted’s treatment. We would have done it somehow but midway through his diagnosis there was talk about referring him to a specialist for a CT scan and that was going to be very expensive indeed. Also, we might have had to have treatment on top of anything they found. The overriding question is how much would, or could, you do for your gundog? I would never want to be in the position of not being able to give one of my dogs the best chance of recovery from illness or an accident because I couldn’t afford the vet’s fees.

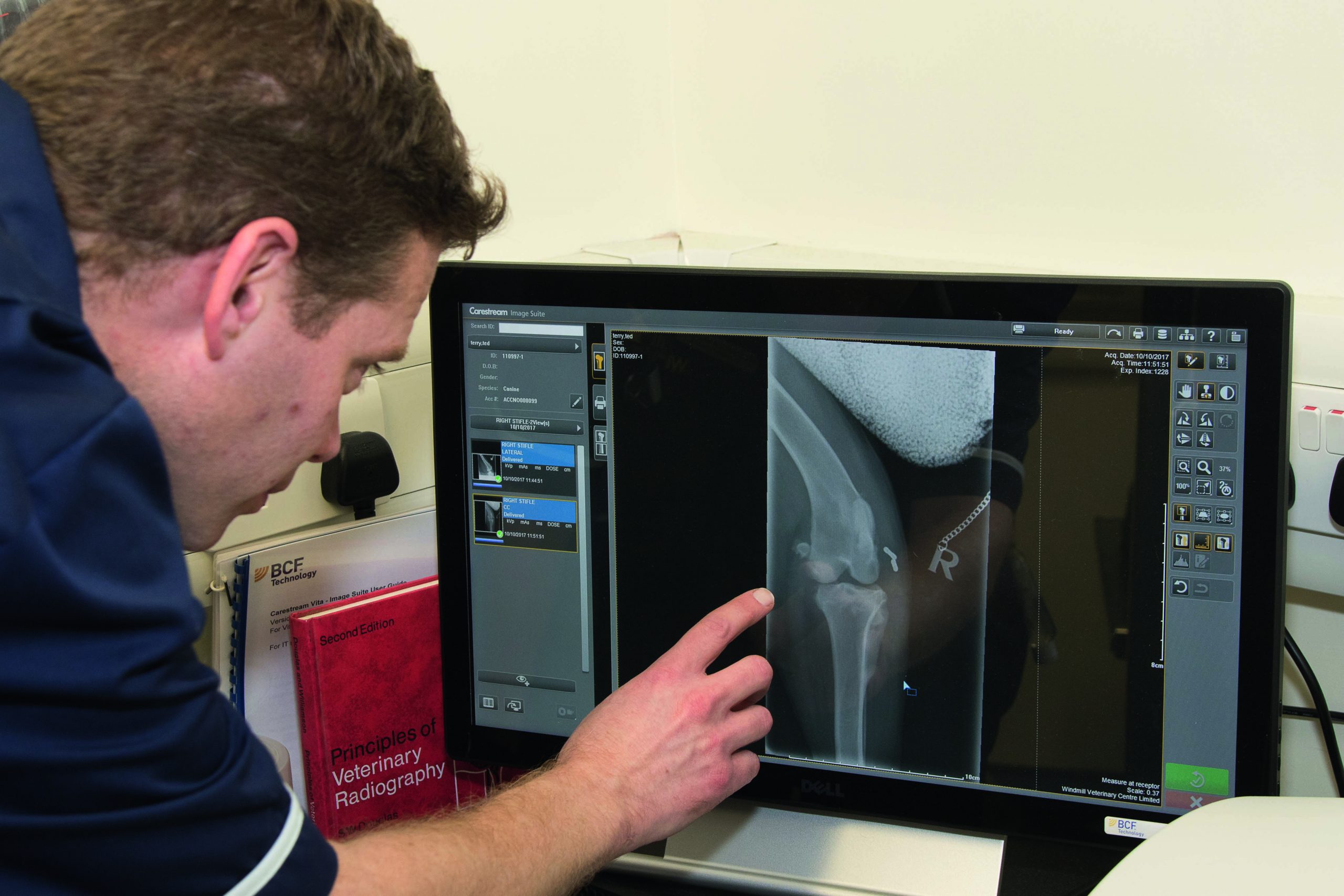

X-rays can cost several hundred pounds

The monthly cost of a reasonable level of insurance cover is the equivalent of a round of clays, the wages for a day’s picking-up or a decent takeaway. My dogs are worth far more than any of those. The stress of having an ill or injured dog is bad enough without the added worry of whether you can pay for any treatment. Any insurance is a double-edged sword and in most cases you never want to claim as if you do it means something terrible has happened. The flip side is that you keep paying out premiums month after month and never benefit from the outlay, which, ironically, is a good thing.

If you have a multi-dog household the monthly premium costs will be even more expensive. With five dogs in the Ridley household we know this only too well. However, this past month has taught us an important lesson and I have added both Twig and Dott to our policy. Fuss, at nearly 13, is too old to be insured, so we have a piggy bank for him. I truly hope we never have to make another claim or break the piggy bank open but at least I can now sleep easier.

Accidents will happen, but will you be able to afford the vet’s fees?

Related Articles

Get the latest news delivered direct to your door

Subscribe to Shooting Times & Country

Discover the ultimate companion for field sports enthusiasts with Shooting Times & Country Magazine, the UK’s leading weekly publication that has been at the forefront of shooting culture since 1882. Subscribers gain access to expert tips, comprehensive gear reviews, seasonal advice and a vibrant community of like-minded shooters.

Save on shop price when you subscribe with weekly issues featuring in-depth articles on gundog training, exclusive member offers and access to the digital back issue library. A Shooting Times & Country subscription is more than a magazine, don’t just read about the countryside; immerse yourself in its most authoritative and engaging publication.