News

Government launches consultation on IHT reliefs for trusts

Would you like to speak to our readers? We offer sponsored articles and advertising to put you in front of our audience. Find out more. Steve Reed asks UK landowners to come up with plans for nature recovery

Steve Reed asks UK landowners to come up with plans for nature recovery

The UK government has launched a technical consultation on the proposed changes to agricultural and business property reliefs for trusts.

The consultation, which is open until 23 April 2025 focuses on how the new rules will affect property settled into trusts, with a particular emphasis on the £1m allowance for property qualifying for full agricultural property relief (APR) or business property relief (BPR).

An unexpected part of the consultation canvasses views on an “anti-fragmentation” rule, which seeks to prevent individuals from reducing their IHT liabilities by settling property into multiple trusts. This had not previously been suggested and could mean property owned by the person creating the trust could be valued as if they still owned the trust’s assets, even though there are no circumstances in which they can benefit from them.

Louise Speke, chief tax adviser to the Country Land and Business Association said: “Trusts are not there to avoid paying tax, they are useful to help families manage their finances. They have been part of the English legal system for centuries, and are used for a myriad of reasons – rarely to do with tax – to help families provide ongoing management of farmland and businesses.”

NFU president Tom Bradshaw said it was “incredibly disappointing” that the government had chosen to only focus on one part of the planned IHT changes.

Related articles

News

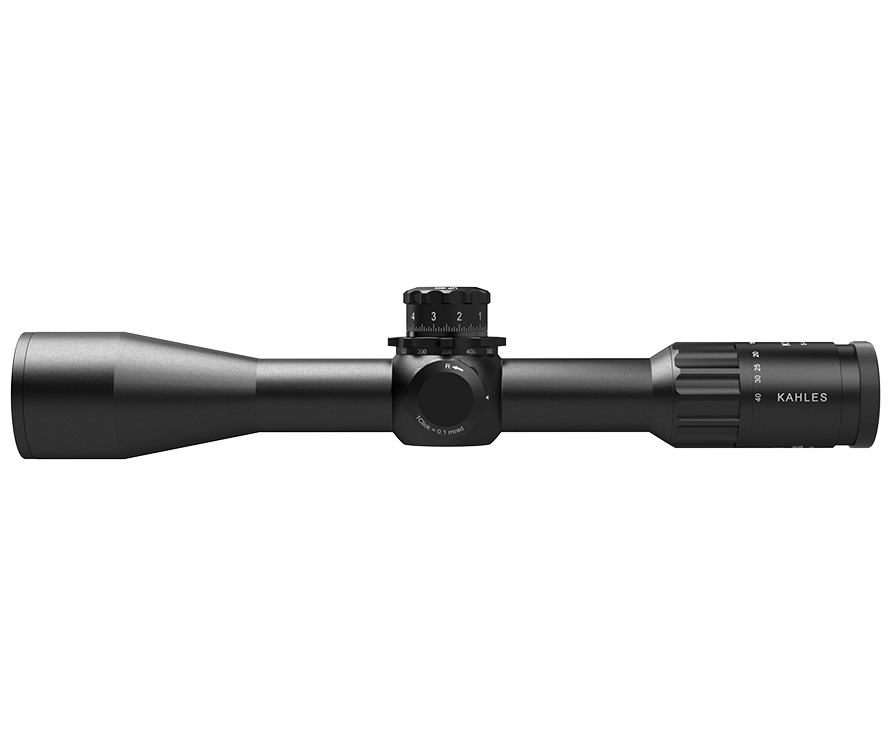

A sound decision as moderators to be taken off licences

The Government has finally confirmed what the shooting community has long argued – that sound moderators should be removed from firearms licensing controls

By Time Well Spent

Gamekeeping news

News

Devastating effects of keepers downing tools

A 20-year experiment highlights the dramatic decline in our red-listed birds after predator control ends, proving the vital role of gamekeepers

By Time Well Spent

Manage Consent

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.